Últimas Notícias

Conheça mitos e verdades sobre a salsicha

É possível que você já tenha ouvido várias curiosidades sobre a salsicha, não é...

Mais valiosos que ouro: conheça esses objetos bizarros

A conta não é tão fácil de ser feita porque o ouro é pesado...

Conheça os reality shows super bizarros que já existiram

Você pode até achar que já viu de tudo na TV, mas não. Vamos...

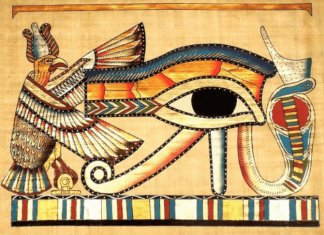

7 ideias de tatuagens egípcias – Conheça os significados

Em algum momento da história das tatuagens, a gente chega ao Egito. Afinal, a...

Concurso de quem come mais cachorro quentes é tradição nos Estados Unidos

Recentemente, a imprensa internacional divulgou uma notícia na categoria de curiosidades e que deixou...

Esses famosos se arrependeram das tatuagens que fizeram

Fazer uma tatuagem em homenagem a outra pessoa é a coisa mais comum do...